|

|

Persons wishing to file a declaration of candidacy for the offices of Prosecuting Attorney, Sheriff or County Committeeman/Committeewoman, on opening day of filing, Tuesday, February 27, 2024, may do so at the Jackson County Courthouse, 415 E. 12th Street, Kansas City, Missouri. All filers must use the west entrance located on Oak Street, which will open at 7:00am.

Anyone wishing to file for office will be asked to form a single file line inside the building prior to proceeding through the security checkpoint. An associate from the County Clerk’s Office will distribute numbers to those in line. Filers will then proceed to the second floor and form a line in numerical order outside the glass doors marked LEGISLATIVE OFFICES. The County Clerk’s Office will open at 8:00am to accept declarations. Representatives from each political party will be present to accept filing fees. To expedite this process, each filer should have their current voter I.D. card needed to complete the declaration form. Filers for Prosecuting Attorney and Sheriff should additionally have the Department of Revenue (DOR) Form 5120, Candidate’s Affidavit of Tax Payments (not required for County Committee candidates). Each filer will approach the counter when their number is called, provide their filing fee receipt and complete all required paperwork. If you have any questions regarding this procedure, kindly contact Mary Jo Spino, Clerk of the County Legislature at [email protected]. Jackson County Public Works Environmental Health Division inspects all restaurants, grocery stores, schools, mobile food and temporary food establishments in the City of Grain Valley. The following violations were reported in the last 7 days:

El Maguey Mexican Restaurant 102 Buckner Tarsney Road Warewashing machine not reading proper sanitizer. Repeat. Re-inspection required. Scheduled 2/16/24. Three compartment sink will be utilized for wash, rinse and sanitized until repairs are made. Porky's Blazin BBQ 9512 S Buckner Tarsney Rd Observed sanitizer at three compartment sink too weak. (below 200ppm). Corrected on site. (tablets added) Culver's of Grain Valley 1180 S Buckner Tarsney Rd Observed clean utensils stored in a dirty storage drawer. Corrected on site. (drawer cleaned, utensils rewashed) Warewashing machine was not reading correct sanitizer. Corrected on site. (sanitizer refilled) After months of community debate and speculation, the Kansas City Royals announced plans Tuesday to relocate to the Crossroads district in downtown Kansas City. Jackson County voters will decide in April whether to extend the current 3/8 cent tax that supports Kauffman and Arrowhead Stadiums for the next 40 years. “We are thrilled to announce our plans to contribute community dynamics, an incredible stadium experience, and long-term growth to The Crossroads – a neighborhood ballpark home for the Royals that will stand strong for the next 50 years here in Jackson County," Royals Chairman and CEO John Sherman said. “And we’re excited to build that new home without costing taxpayers a penny more.” In a release following the announcement, Jackson County Executive Frank White welcomed the announcement of a site location. "For months, we've stressed the importance of selecting a site to move forward effectively with negotiations and to provide a clear basis for the proposal before it goes to the voters,” White said. “I am pleased that the Royals have taken this significant step. It is a decision that marks progress in our journey towards a resolution that will shape the future of our county." In the release, White underscored the urgency of engaging in an open, transparent and thoroughly honest discussion about the proposal, especially given its imminent placement on the April ballot. "The time for broad overviews has passed,” White said. “As this issue heads to the ballot, it is crucial for all parties involved to commit to a dialogue that leaves no question unanswered, and no detail obscured. This is a monumental decision for Jackson County, involving an investment of over $2 billion by our taxpayers. They deserve to understand every aspect of what this entails." For more information on the proposed stadium and site plan, visit Kansas City Royals Stadium (kcballparkdistrict.com) The Kansas City Royals released renderings of a proposed stadium to be located in the Crossroads district of downtown Kansas City. Voters will decide in April whether to extend the current 3/8 tax to support the relocation. Photo credit: Kansas City Royals

Jackson County Public Works Environmental Health Division inspects all restaurants, grocery stores, schools, mobile food and temporary food establishments in the City of Grain Valley. The following violations were reported in the last 7 days:

El Tequilazo Cocina Y Cantina LLC 522 S Main Street Observed raw chicken stored above raw beef. Corrected on site. (chicken moved to bottom shelf) Lin's Kitchen 111 SW Eagles Parkway Observed raw chicken stored above raw beef and ready-to-eat foods. Corrected on site. (raw chicken moved) Observed foods in walk in cooler not properly date marked. Corrected on site. (date marked) Observed printed menu paper being used as food contact surfaces for cooked product for storage. Corrected on site. (paper discarded) Observed face lotions and perfumes stored with food. Corrected on site. (toxins removed) On September 18th, 2023, the Jackson County Legislature passed Ordinance #5787 enacting a property tax credit to eligible taxpayers within Jackson County, Missouri, in accordance with the Revised Statutes of Missouri §137.1050 (SB190). The program will be administered by the Collections Department who have been working on an implementation plan for those eligible taxpayers to apply for the tax credit.

With the tax credit going into effect in 2024, there has been a marked increase of calls and emails requesting information on the application process, which does not yet exist. Due to many constituent inquiries to Legislator Abarca's office pertaining to the implementation of SB190 through Ordinance #5787, his office is collecting contact information for those who are awaiting details on eligibility and/or how to apply. Once the Collection Department provides details on how to apply, the contact information gathered through this form will be shared with the Collections Department to ensure constituents who signed up to receive information can immediately obtain timely details. This form is intended to ensure that anyone who reaches out to Legislator Abarca’s office regarding this topic obtains information as promptly as it is made available. The form is available here. Questions can be addressed to [email protected] or (816)881.346 A Grain Valley man faces felony charges for the fatal Christmas Day shooting of another man inside a Grain Valley residence, Jackson County Prosecutor Jean Peters Baker announced December 27th.

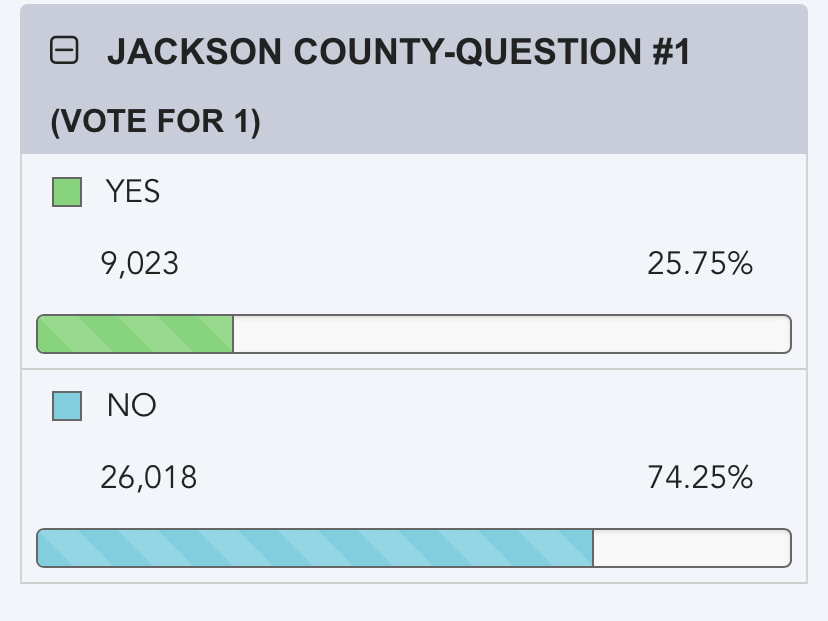

Franklin Ray Eason faces Murder 2nd Degree and Armed Criminal Action charges. According to court records, Grain Valley police officers were dispatched on Dec. 25, 2023, to SW Woodland Circle regarding a shooting. Officers found a victim inside a residence. He had suffered a fatal gunshot wound. Witnesses told police detectives that the victim came into the room with a handgun but put the firearm down on a table. The defendant picked it up and shot the victim, a witness told police. The Missouri Highway Patrol processed the crime scene. The defendant is in custody on a $100,000 bond. Charging documents: Microsoft Word - 2. PROBABLE CAUSE-F. Eason.doc (jacksoncountyprosecutor.com) The 14.7% of Jackson County voters who managed to make it to the polls on Tuesday, November 7th swiftly voted down a use tax proposed by the county.

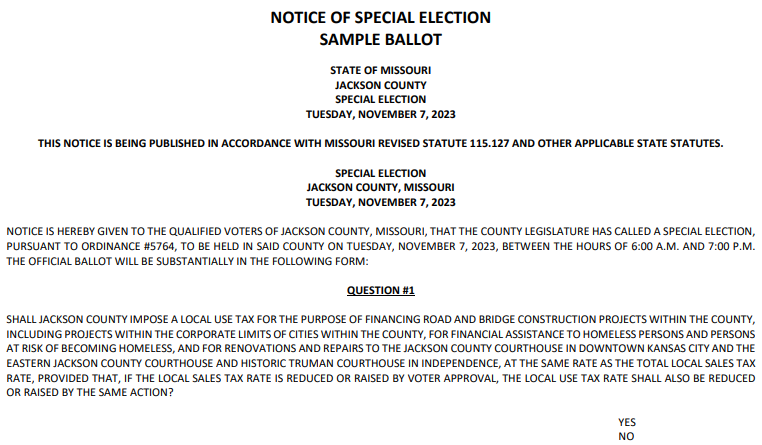

As previously reported, the use tax would have applied to online purchases from an out-of-state seller where no other tax is paid. (Unofficial results per the Jackson County Election Board provided in graphic below). Jackson County will ask voters to decide on a use tax as the sole issue on the November 7th ballot.

The ballot language states: SHALL JACKSON COUNTY IMPOSE A LOCAL USE TAX FOR THE PURPOSE OF FINANCING ROAD AND BRIDGE CONSTRUCTION PROJECTS WITHIN THE COUNTY, INCLUDING PROJECTS WITHIN THE CORPORATE LIMITS OF CITIES WITHIN THE COUNTY, FOR FINANCIAL ASSISTANCE TO HOMELESS PERSONS AND PERSONS AT RISK OF BECOMING HOMELESS, AND FOR RENOVATIONS AND REPAIRS TO THE JACKSON COUNTY COURTHOUSE IN DOWNTOWN KANSAS CITY AND THE EASTERN JACKSON COUNTY COURTHOUSE AND HISTORIC TRUMAN COURTHOUSE IN INDEPENDENCE, AT THE SAME RATE AS THE TOTAL LOCAL SALES TAX RATE, PROVIDED THAT, IF THE LOCAL SALES TAX RATE IS REDUCED OR RAISED BY VOTER APPROVAL, THE LOCAL USE TAX RATE SHALL ALSO BE REDUCED OR RAISED BY THE SAME ACTION? The use tax, if approved, would apply to online purchases from an out-of-state seller where no other tax is paid. The use tax would not apply to individuals living in Missouri ordering online from a Missouri-based business. The state already charges a 4.225% use tax rate for these purchases. Polls will be open from 6 a.m. to 7 p.m. on Tuesday, November 7th. To find your polling place, visit On the Ballot | Jackson County Missouri Election Board (jcebmo.org). In an effort to reach busy adults who may not have time to schedule their flu shot or COVID-19 booster, Jackson County Public Health (JCPH) is offering a free drive-through clinic on Friday, October 20th at Lake Jacomo.

The drive thru clinic will be open Friday, October 20th from 10am-3pm at Lake Jacomo Shelter #3 (7301 W Park Rd, Blue Springs, MO 64015). JCPH will have the updated Pfizer COVID-19 booster, as well as this year’s influenza vaccine available for everyone 6 months of age and older. Vaccines are free while supplies last. Preregister online today at www.jcph.org. Free at-home COVID-19 tests, hand sanitizer, and other give aways are planned. Good News: Jackson County Parks + Rec presents 47th Annual Fall Festival of Arts, Crafts and Music9/28/2023

Fall is in the air! Usher in the season by spending the day with your family at Jackson County Parks + Rec’s 47th Annual Fall Festival of Arts, Crafts and Music at the Missouri Town Living History Museum, Saturday and Sunday, October 7-8, 2023.

The wildly popular open-air event takes place on the grounds of Jackson County Parks + Rec’s Missouri Town, a living history museum on 30 acres that delights visitors with glimpses of life from a mid-19th century farming community. The 47th Annual Fall Festival of Arts, Crafts and Music will be held Saturday, Oct. 7 from 10 a.m. – 5 p.m. and Sunday, Oct. 8 from 10 a.m. – 5 p.m. Missouri Town Living History Museum is located at 8010 East Park Rd, Lee’s Summit, MO 64064. The event cost is $15 per car/van and $25 per school/commercial bus. At the Missouri Town Fall Festival, the entire village comes alive with the authentic music and dance of the 1850s. Start your holiday shopping with unique gifts, handcrafted by talented artisans. Knowledgeable interpreters will share their passion for bygone skills such as cooking over a wood fire, wood working, blacksmithing, the art of tinsmith and a variety of fiber crafts. Witness the preparation of homemade apple butter and cider. Children will find fun and excitement with the time-honored games that were popular with kids over 150 years ago! Whether ending your visit with a hay wagon ride or simply strolling through the authentic antebellum architecture, families will enjoy a special day of the sights, sounds and smells of a simpler time in this reconstructed mid-1900s farming community! For more information, visit www.makeyourdayhere.com/missouritown. |

Categories

All

Archives

July 2024

|

Grain Valley NewsGrain Valley News is a free community news source published weekly online. |

Contact Us |

RSS Feed

RSS Feed