|

|

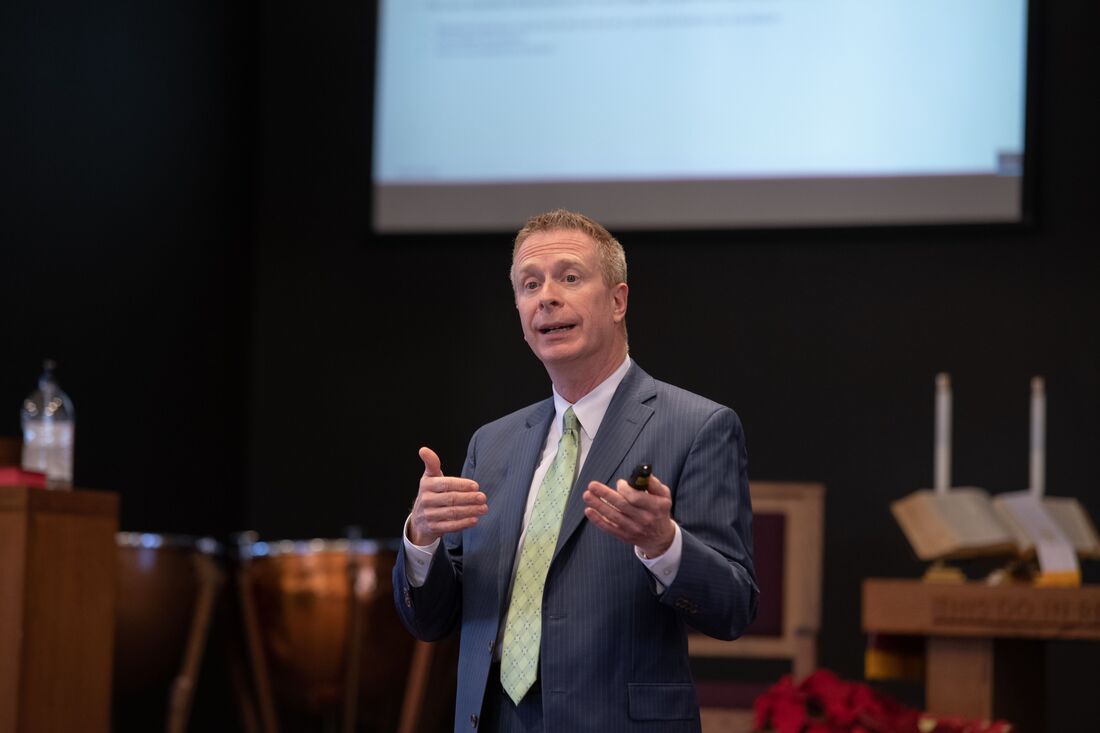

With the merriment of the holiday season behind us, the start of a new year brings less festive realities for businesses and individuals, including tax preparation and planning. Lorne Meinershagen, CPA, Managing Member of Meinershagen & Co., brought some practical advice and levity regarding business tax issues to the Grain Valley Partnership’s January luncheon. Meinershagen reviewed how the structuring of a business (sole proprietorship, partnership, corporations, etc.) can impact a business owner’s liability as well as issues related to taxes. Meinershagen emphasized the importance of reaching out to and establishing a relationship with a trusted tax advisor, preferably prior to setting up a business, to ensure the business is structured in a way to best protect the owner from liability and ensure proper tax planning. Meinershagen & Co. provides tax planning and preparation for businesses and individuals, preparation of financial statements, consulting on business start-up needs, payroll services, accounting software support, and assistance with business and personal tax problems. To schedule an appointment, call 816-847-0536 or visit www.floydmeinershagenandco.com. The Partnership’s February luncheon will be held Tuesday, February 4th. For more information about the Grain Valley Partnership and their upcoming events, visit www.growgrainvalley.org. Lorne Meinershagen, CPA, Managing Member of Meinershagen & Co., spoke to Grain Valley Partnership members about tax tips and strategies for businesses at the Partnership’s January 7th luncheon.

Photo credit: Diana Luppens, Switch Focus Studios Comments are closed.

|

Categories

All

Archives

July 2024

|

Grain Valley NewsGrain Valley News is a free community news source published weekly online. |

Contact Us |

RSS Feed

RSS Feed